For businesses in need of strategic financial guidance, the finance business partner and the fractional chief financial officer play different, but crucial roles.

As companies strive to optimize their financial operations and drive growth, understanding the nuances between these roles is important for making informed hiring decisions. Monarch Talent Solutions collaborated with President of Brady CFO, Mason Brady, to explore the distinctions between a finance business partner and a fractional CFO, offering insights into their respective functions and value propositions.

Understanding the Finance Business Partner Role

The finance business partner role originates more as a mentality than a strictly defined position, influenced by Northern European concepts, as mentioned in the book Create Value as a Finance Business Partner. Mason says that “this role focuses on serving other departments within the organization by providing financial data and insights to aid decision-making and increase profitability”.

Finance business partners collaborate with departments such as sales, marketing, and operations to turn them into profit centers and enhance overall departmental success. They can operate in both centralized and decentralized organizational structures, coordinating with departmental leaders to provide financial support.

Unlike traditional finance roles, finance business partners are less focused on day-to-day financial operations like closing the books or financial reporting. Mason emphasizes that this role utilizes financial insights to support other departments, providing the information necessary for aligned success and growth of the whole organization.

Understanding the Fractional CFO Role

A fractional CFO has a more defined role, direct correlation to the finance team, and specific set of responsibilities compared to a finance business partner. Fractional CFOs usually work on a contract basis to support organizations during times of transition. They are ultimately responsible for ensuring the financial health and sustainability of the business, including managing risk and securing financing.

Mason highlights that fractional CFOs are involved in tasks such as helping clients obtain financing, developing growth plans, and forecasting cash flow to prevent liquidity issues. They require strong leadership skills and are deeply involved in strategic decision-making, such as managing risk and working with insurance brokers.

The fractional CFO role is more comprehensive than that of a finance business partner, encompassing broader leadership and risk management responsibilities within the organization. While a finance business partner role can be considered a mindset, the fractional CFO’s role is more expansive, focusing on ensuring the organization does not run out of financing and providing effective financial management.

How a Finance Business Partner and a Fractional CFO Impact Business Performance Differently

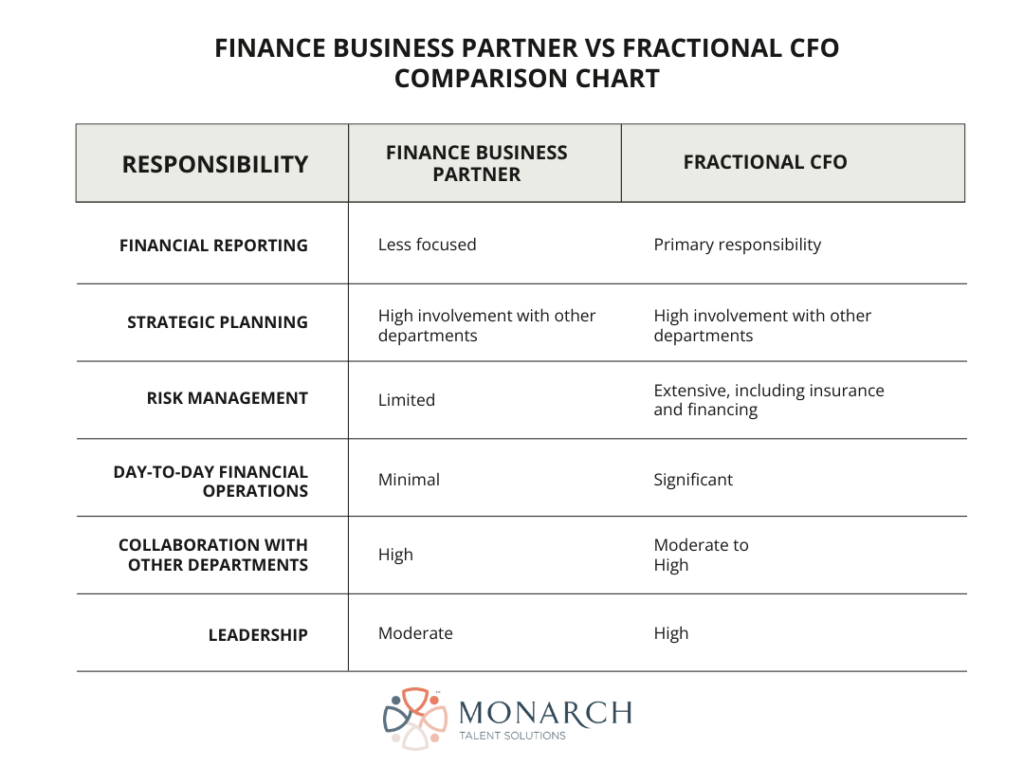

Both roles significantly impact business performance. Here’s how they differ:

Finance Business Partner:

- Enhances decision-making across departments by providing relevant financial insights.

- Drives financial growth by turning departments into profit centers.

- Improves departmental efficiency and strategic alignment.

Fractional CFO:

- Ensures overall financial health and sustainability during business transformations.

- Secures necessary financing to support growth.

- Manages risk effectively to safeguard the business.

Conclusion: Making the Right Choice for Your Financial Leadership Needs

When deciding between a finance business partner and a fractional CFO, consider the following factors:

- Company Size and Revenue: Smaller companies (under $50 million in revenue) may benefit more from a fractional CFO vs a full-time CFO, while larger companies might need both a full-time CFO and finance business partner roles.

- Current Financial Health: If your company faces immediate financial challenges or is looking to scale between $5-40 million in revenue, a fractional CFO might be more suitable.

- Leadership and Risk Management: For extensive leadership and risk management, a fractional CFO is necessary.

Choosing the appropriate role enables businesses to optimize their finance function, drive performance, mitigate risks, and safeguard financial integrity. It also sets the stage for professional growth and development, allowing finance professionals to leverage their skills and expertise effectively while contributing meaningfully to long-term success.

Finding the ideal finance business partner or fractional CFO is challenging, but it doesn’t have to be when you partner with Monarch Talent Solutions. With our expertise in finance recruitment and access to a vast network of top-tier candidates, we can help your organization identify and hire your next finance leader who embodies the strategic vision, analytical skills, communication prowess, adaptability, ethical integrity, and results-oriented focus your organization requires.

By understanding the distinct roles and benefits of a finance business partner and a fractional CFO, businesses can make informed decisions that enhance their financial management capabilities and drive sustainable growth in today’s competitive marketplace.